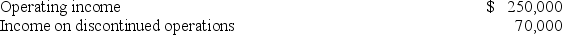

Freda's Florist reported the following before-tax income statement items for the year ended December 31, 2018:  All income statement items are subject to a 40% income tax rate. In its 2018 income statement, Freda's separately stated income tax expense and total income tax expense would be:

All income statement items are subject to a 40% income tax rate. In its 2018 income statement, Freda's separately stated income tax expense and total income tax expense would be:

A) $128,000 and $128,000, respectively.

B) $128,000 and $100,000, respectively.

C) $100,000 and $128,000, respectively.

D) $100,000 and $100,000, respectively.

Correct Answer:

Verified

Q19: The direct and indirect methods of reporting

Q20: Income statements prepared according to both U.S.

Q21: Earnings quality refers to:

A) the ability of

Q22: Income smoothing refers to:

A) the ability of

Q23: Most real-world income statements are presented using

Q25: Provincial Inc. reported the following before-tax income

Q26: The difference between single-step and multiple-step income

Q27: The decomposition of return on assets illustrates

Q28: In a statement of cash flows prepared

Q29: A primary advantage of the multiple-step format

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents