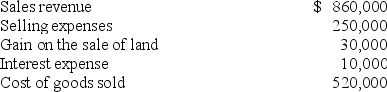

A company reports the following amounts at the end of the current year:  Under normal circumstances (ignoring tax effects) , permanent earnings would be computed as:

Under normal circumstances (ignoring tax effects) , permanent earnings would be computed as:

A) $90,000.

B) $110,000.

C) $80,000.

D) $50,000.

Correct Answer:

Verified

Q49: The distinction between operating and nonoperating income

Q50: On May 1, Foxtrot Co. agreed to

Q51: A common component of income excluded from

Q52: On May 1, Foxtrot Co. agreed to

Q53: Restructuring costs typically can be defined as:

A)

Q55: On October 28, 2018, Mercedes Company committed

Q56: On October 28, 2018, Mercedes Company committed

Q57: Howard Co.'s 2018 income from continuing operations

Q58: On May 1, Foxtrot Co. agreed to

Q59: Major Co. reported 2018 income of $300,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents