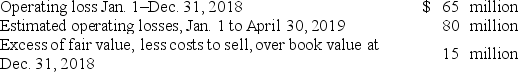

On November 1, 2018, Jamison Inc. adopted a plan to discontinue its barge division, which qualifies as a separate component of the business according to GAAP regarding discontinued operations. The disposal of the division was expected to be concluded by April 30, 2019. On December 31, 2018, the company's year-end, the following information relative to the discontinued division was accumulated:  In its income statement for the year ended December 31, 2018, Jamison would report a before-tax loss on discontinued operations of:

In its income statement for the year ended December 31, 2018, Jamison would report a before-tax loss on discontinued operations of:

A) $65 million.

B) $50 million.

C) $130 million.

D) $145 million.

Correct Answer:

Verified

Q41: Non-GAAP earnings:

A) could be considered management's view

Q42: Which of the following mostly likely would

Q43: The principal benefit of separately reporting discontinued

Q44: On August 1, 2018, Rocket Retailers adopted

Q45: On May 1, Foxtrot Co. agreed to

Q47: The Claxton Company manufactures children's toys and

Q48: Temporary earnings are best characterized as:

A) earnings

Q49: The distinction between operating and nonoperating income

Q50: On May 1, Foxtrot Co. agreed to

Q51: A common component of income excluded from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents