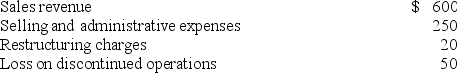

Misty Company reported the following before-tax items during the current year:

-Misty's effective tax rate is 40%. What is Misty's income from continuing operations?

A) $198.

B) $210.

C) $330.

D) $360.

Correct Answer:

Verified

Q68: Operating cash outflows would include:

A) Purchase of

Q69: For the statement of cash flows, short-term

Q70: The Maytag Corporation's income statement includes income

Q71: A change in accounting principle that is

Q72: Reporting comprehensive income according to International Financial

Q74: Cendant Corporation's results for the year ended

Q75: Operating cash flows would not include:

A) Interest

Q76: Misty Company reported the following before-tax items

Q77: When a material error is discovered in

Q78: Reporting comprehensive income can be accomplished by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents