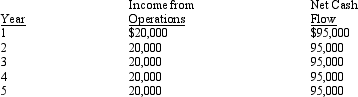

The management of River Corporation is considering the purchase of a new machine costing $380,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for 5 years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability in this situation:  The net present value for this investment is:

The net present value for this investment is:

A) Positive $20,140

B) Negative $20,140

C) Positive $19,875

D) Negative $19,875

Correct Answer:

Verified

Q118: The management of Indiana Corporation is considering

Q119: The management of River Corporation is considering

Q120: Below is a table for the present

Q122: The production department is proposing the purchase

Q124: All of the following qualitative considerations may

Q125: Which of the following is true of

Q126: Which of the following provisions of the

Q127: Below is a table for the present

Q128: The production department is proposing the purchase

Q146: All of the following are factors that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents