Project A requires an original investment of $50,000. The project will yield cash flows of $15,000 per year for seven years. Project B has a calculated net present value of $13,500 over a four year life. Project A could be sold at the end of four years for a price of $25,000. (a) Using the proper table below determine the net present value of Project A over a four-year life with salvage value assuming a minimum rate of return of 12%. (b) Which project provides the greatest net present value?

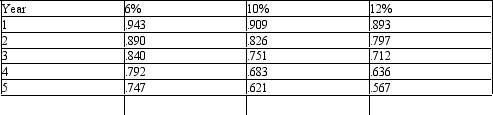

Below is a table for the present value of $1 at compound interest.

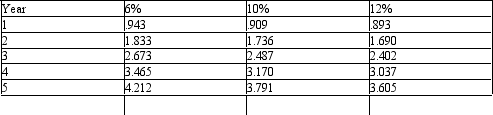

Below is a table for the present value of an annuity of $1 at compound interest.

Below is a table for the present value of an annuity of $1 at compound interest.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q142: A company is contemplating investing in a

Q143: A project is estimated to cost $273,840

Q144: A project has estimated annual cash flows

Q145: A project has estimated annual net cash

Q148: Project A requires an original investment of

Q149: An 6-year project is estimated to cost

Q150: A project is estimated to cost $248,400

Q151: What is the present value of $8,000

Q152: A project has estimated annual cash flows

Q155: In capital rationing, alternative proposals that survive

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents