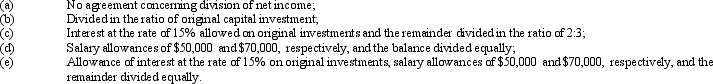

Holly and Luke formed a partnership, investing $240,000 and $80,000, respectively. Determine their participation in the year's net income of $200,000 under each of the following independent assumptions:

Correct Answer:

Verified

Q149: Soledad and Winston are partners who share

Q156: The capital accounts of Hawk and Martin

Q159: The capital accounts of Hawk and Martin

Q160: The capital accounts of Harrison and Marti

Q162: Gentry, sole proprietor of a hardware business,

Q163: Emerson and Dakota formed a partnership dividing

Q166: .Daja and Whitnee had capital balances of

Q169: Trevor Smith contributed equipment, inventory, and $54,000

Q194: Malcolm has a capital balance of $90,000

Q196: Prior to liquidating their partnership, Craig and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents