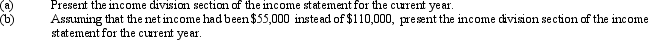

Sharp and Townson had capital balances of $60,000 and $90,000 respectively at the beginning of the current fiscal year. The articles of partnership provide for salary allowances of $25,000 and $30,000 respectively, an allowance of interest at 12% on the capital balances at the beginning of the year, with the remaining net income divided equally. Net income for the current year was $110,000.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q161: What is a partnership? List three advantages

Q174: Sharp and Townson had capital balances of

Q175: Gleason invested $90,000 in the James and

Q176: Gavin invested $45,000 in the Jason and

Q177: Jeff Layton, sole proprietor of a hardware

Q178: Match the term with the appropriate definition.

Q180: Prior to liquidating their partnership, Porter and

Q181: After discontinuing the ordinary business operations and

Q182: Jackson and Campbell have capital balances of

Q184: Immediately prior to the process of liquidation,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents