Refer to the Financial Statements for Wal*Mart, Below

Wal"Mart (in millions) | Consolidated Statements of Operations Fiscal Year Ended | ||||||

| 31-Jan X2 | 31-Jan X3 | 31-Jan X4 | 31-Jan X5 | 31-Jan X6 | 31-Jan X7 | 31-Jan X8 | |

| Net sales | $ 43,887 | $ 55,484 | $ 67,345 | $ 82,494 | $ 93,627 | $ 104,859 | |

| Rentals from licensed dept | 28 | 36 | 47 | ||||

| Other income-net | 374 | 465 | 593 | 918 | 1,122 | 1,287 | |

| Total revenues | 44,289 | 55,985 | 67,985 | 83,412 | 94,749 | 106,146 | 118,884 |

| Cost of sales | 34,786 | 44,174 | 53,444 | 65,586 | 74,564 | 83,663 | |

| Operating, Selling, General& Administrative Expenses | 6,684 | 8,321 | 10,333 | 12,858 | 14,951 | 16,788 | |

| Total operating expenses | 41,470 | 52,495 | 63,777 | 78,444 | 89,515 | 100,451 | |

| Operating income | 2,819 | 3,490 | 4,208 | 4,968 | 5,234 | 5,695 | 6,378 |

| Interest costs | |||||||

| Debt | 113 | 143 | 331 | 520 | 692 | 629 | |

| Capital leases | 153 | 180 | 186 | 186 | 196 | 216 | |

| 266 | 323 | 517 | 706 | 888 | 845 | 930 | |

| Income before taxes | 2,553 | 3,167 | 3,691 | 4,262 | 4,346 | 4,850 | 5,449 |

| Income tax expense | |||||||

| Current | 906 | 1,137 | 1,325 | 1,572 | 1,530 | 1,974 | |

| Deferred | 39 | 35 | 33 | 9 | 76 | (180) | |

| 945 | 1,172 | 1,358 | 1,581 | 1,606 | 1,794 | 2,016 | |

| Net income | $ 1,608 | $ 1,995 | $ 2,333 | $ 2,681 | $ 2,740 | $ 3,056 | $ 3,433 |

| EPS | $ 0.70 | $ 0.87 | $ 1.02 | $ 1.17 | $ 1.19 | $ 1.33 | |

| Dividends per share (for the whole year) | $ 0.09 | $ 0.11 | $ 0.13 | $ 0.17 | $ 0.20 | $ 0.21 | |

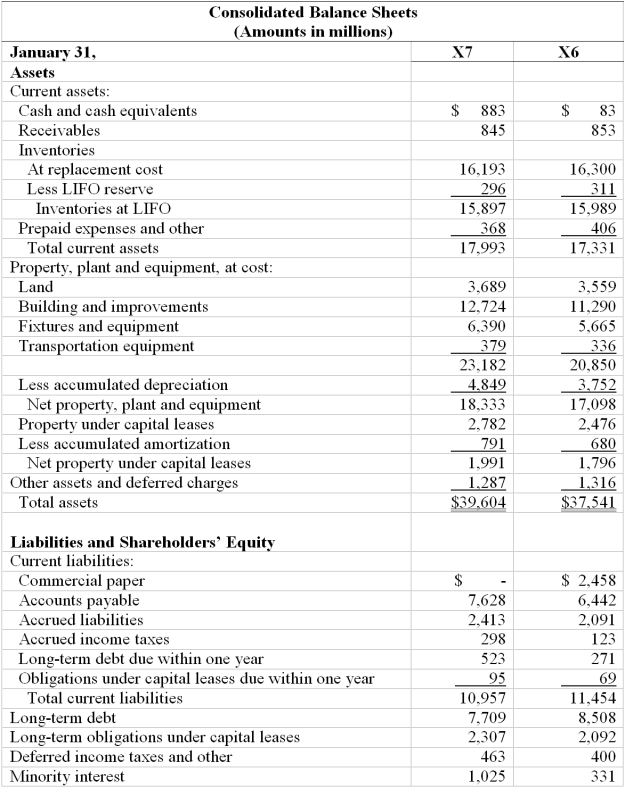

a. Calculate for X7 the ratios listed below. X6 numbers are provided for comparative purposes.

b. Working capital management is an important consideration for many companies. Which component of Wal*Mart's working capital do you think it spends most time managing? That is, which component is likely to be the most important? Why? What has happened to this component from X6 to X7?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Financial ratios are often used in models

Q84: Dividends on preferred stock with characteristics of

Q85: Capitalization of interest results in an understatement

Q88: A joint venture may result in significant

Q88: Guaranteed debt of unconsolidated subsidiaries should generally

Q89: "Trading on the equity" means that a

Q91: Altman's Z-score uses multiple discriminant analysis in

Q91: Debt may contain sinking fund provisions. This

Q93: The greater the variability of sales the

Q94: Debt is better than equity because the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents