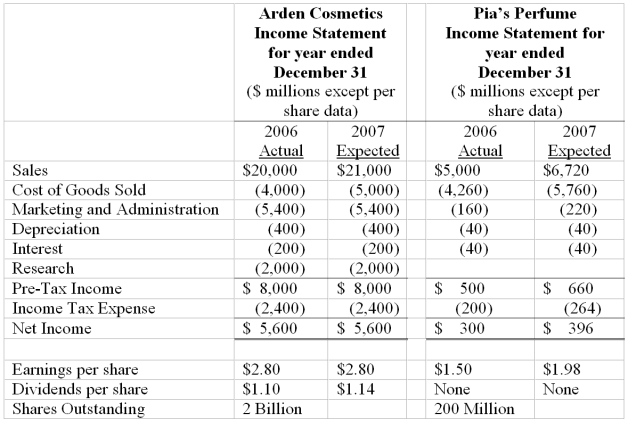

Below are the financial statements for Arden Cosmetics and Pia's Perfume.

Arden is considering two alternative approaches to making the acquisition of Pia: share-for-share exchange or cash purchase. Assume the following: - The billion dollar cost of purchasing Pia at per share would be financed by debt with a 10 percent interest rate.

- All assets and liabilities of Pia have fair market values equal to their balance sheet values except property, plant and equipment, which have a fair market value of billion. Pia depreciates its property, plant, and equipment over 10 years using the straight-line method.

- The marginal tax rate is 40 percent.

Part a.

Assume Arden uses a share-for-share exchange to acquire Pia and accounts for the transaction as a pooling-of-interests:

i. Prepare a pro forma December 31, 2006 balance sheet for Arden reflecting the acquisition and calculate the resulting book value per share.

ii. Prepare a pro forma estimated 2007 income statement for Arden reflecting the acquisition, and calculate the resulting earnings per share.

Part b.

Assume Arden pays $30 cash per share to acquire 100 percent of the common stock of Pia and accounts for the transaction as a purchase.

i. Prepare a pro forma December 31, 2006 balance sheet for Arden reflecting the acquisition and calculate the resulting book value per share.

ii. Prepare a pro forma estimated 2007 income statement for Arden reflecting the acquisition, and calculate the resulting earnings per share.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q50: If a company has a wholly owned

Q56: Translation is the process under which local

Q57: Reported sales in US dollars of revenues

Q60: When the income statement of a foreign

Q64: Under SFAS 141, accounting for acquisitions can

Q87: If a company chooses the fair value

Q93: SFAS 159 allows companies to selectively report

Q95: You are analyzing the financial statements of

Q96: Growth Corporation is trading at $102 per

Q97: SFAS 142 requires that goodwill be tested

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents