Use the following to answer questions

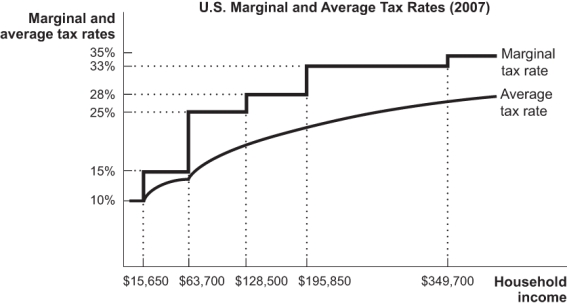

Figure: U.S.Marginal and Average Tax Rates

-(Figure: U.S.Marginal and Average Tax Rates) Using the tax rates shown in the figure,assume your annual income is $15,000,that you have a deduction of $1,800 for moving expenses,and that you claim four exemptions of $3,300: one for yourself and one for each of your three children.How much taxes are you expected to pay?

A) $0

B) $120

C) $132

D) $138

Correct Answer:

Verified

Q27: Suppose the tax rate on the first

Q28: Which of the following represents a change

Q29: Use the following to answer questions

Figure:

Q30: Suppose a high-income individual,subject to a 15%

Q31: The marginal tax rate is:

A) the tax

Q33: The average tax rate is:

A) the tax

Q34: The tax rate on an additional dollar

Q35: The U.S.income tax system is:

A) proportional.

B) progressive.

C)

Q36: Taxpayers in the United States for the

Q37: Which tax rate determines whether it is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents