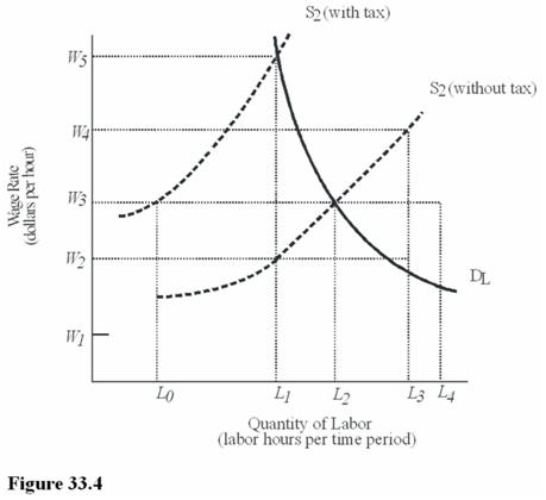

In Figure 33.4, what is the burden of the tax on employers?

In Figure 33.4, what is the burden of the tax on employers?

A) The wage increase of W5 - W3.

B) The wage increase of W5 - W2.

C) The wage increase of W3 - W2.

D) The wage increase of W5 - W1

Correct Answer:

Verified

Q101: With a flat tax,

A)Vertical inequities cannot occur.

B)Everyone

Q102: Flat tax critics

A)Believe it would make it

Q106: Which of the following is an example

Q107: The argument against greater equality in the

Q110: Greater equality in income is supported by

Q111: Since the current tax system is fairly

Q112: Which of the following is an example

Q116: The marginal revenue product (MRP)establishes

A)An upper limit

Q128: The effective tax rate refers to the

Q137: Public education is an in-kind benefit.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents