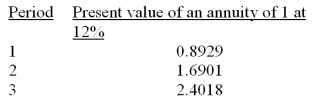

A company is considering the purchase of new equipment for $45,000. The projected after-tax net income is $3,000 after deducting $15,000 of depreciation. The machine has a useful life of 3 years and no salvage value. Management of the company requires a 12% return on investment. The present value of an annuity of 1 for various periods follows:

What is the net present value of this machine assuming all cash flows occur at year-end?

Correct Answer:

Verified

*Annual c...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: A company is considering purchasing a machine

Q104: A company is considering purchasing a machine

Q112: A company is trying to decide

Q119: A company produces two boat models,

Q120: A company produces two boat models,

Q122: A company has a decision to

Q126: A company purchases a machine for $1,000,000.

Q137: A company is evaluating the purchase of

Q146: Identify at least three reasons for managers

Q148: The _ is computed by dividing a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents