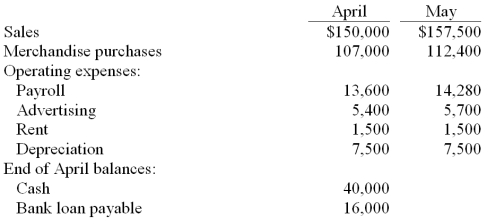

Sweeny Co. is preparing a cash budget for the second quarter of the coming year. The following data have been forecasted:

Additional data:

(1) Sales are 40% cash and 60% credit. The collection pattern for credit sales is 50% in the month following the sale and 50% in the month thereafter. Total sales in March were $125,000.

(2) Purchases are all on credit, with 40% paid in the month of purchase and the balance paid in the following month.

(3) Operating expenses are paid in the month they are incurred.

(4) A minimum cash balance of $40,000 is required at the end of each month.

(5) Loans are used to maintain the minimum cash balance. At the end of each month, interest of 1% per month is paid on the outstanding loan balance as of the beginning of the month. Repayments are made whenever excess cash is available.

Required: Calculate the following items for May

(a) Cash collections from customers.

(b) Cash payments made for merchandise purchases.

(c) Cash paid for other operating expenses, including interest.

(d) What is the preliminary cash balance for May 31?

(e) What loan activity will take place at the end of May?

(f) What is the ending cash balance?

Correct Answer:

Verified

Q141: Use the following data to determine the

Q142: Assume the Crocs shoe company is

Q143: David, Inc. is preparing its master budget

Q148: Del Carpio, Inc. sells two products, Widgets

Q151: Clic, Inc. provides the following data for

Q156: Slim Corp.requires a minimum $8,000 cash balance.If

Q201: _ is a budget system based on

Q203: There are at least five benefits from

Q207: The master budget process nearly always begins

Q211: The budget that lists the dollar amounts

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents