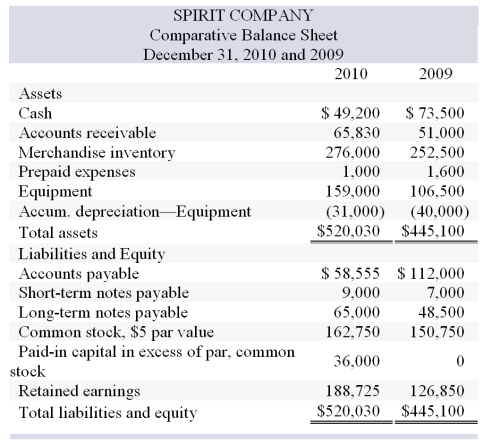

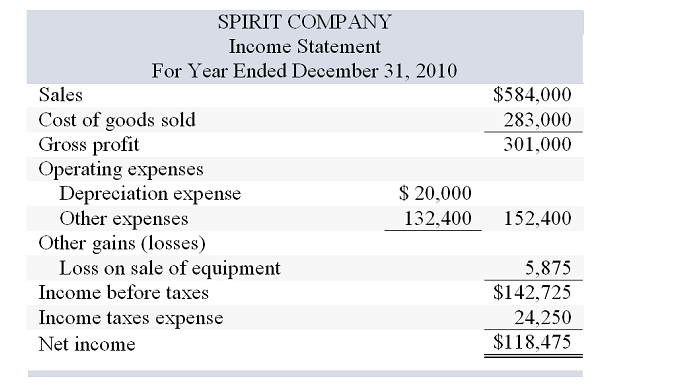

Spirit Company, a merchandiser, recently completed the 2010 calendar year. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses. The company's balance sheet and income statement follow:

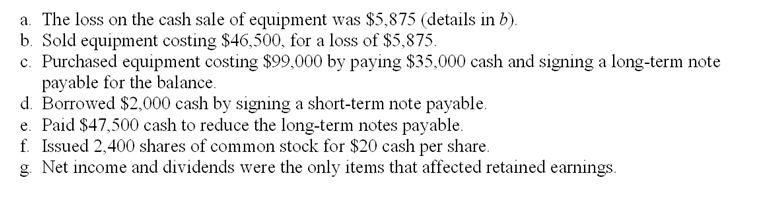

Additional Information on Year 2010 Transactions

Determine the cash received by Spirit for the equipment sold in item C above.

A) $5,875

B) $11,625

C) $46,500

D) $17,500

E) $20,000

Correct Answer:

Verified

Q84: A company reported that its bonds with

Q95: The first line item in the operating

Q97: Use the following information and the indirect

Q98: Given the following information, determine the amount

Q101: A company had wage expense of $750,000

Q107: Wessen Company reports net income of $180,000

Q110: Net income of Lucky Company was $52,000.The

Q115: When analyzing the changes on a spreadsheet

Q116: Use the following information to calculate cash

Q117: Wessen Company reports net income of $200,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents