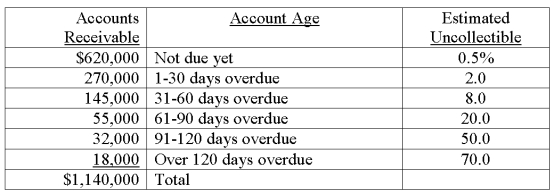

A company uses the aging of accounts receivable method to estimate its bad debts expense. On December 31 of the current year an aging analysis of accounts receivable revealed the following:

Required:

a. Calculate the amount of the Allowance for Doubtful Accounts that should be reported on the current year-end balance sheet

b. Calculate the amount of the Bad Debts Expense that should be reported on the current year's income statement, assuming that the balance of the Allowance for Doubtful Accounts on January 1 of the current year was $44,000 and that accounts receivable written off during the current year totaled $49,200

c. Prepare the adjusting journal entry to record bad debts expense on December 31 of the current year

d. Show how Accounts Receivable will appear on the current year-end balance sheet as of December 31

Correct Answer:

Verified

Q119: What is the maturity date of a

Q121: Welles Company uses the direct write-off method

Q121: The Connecting Company uses the percent of

Q122: The following series of transactions occurred during

Q123: On May 31, a company had a

Q129: Timmons Company had a January 1, credit

Q129: Calculate the total amount of interest that

Q133: ABC Co. sold $80,000 of accounts receivable

Q142: At December 31 of the current year,a

Q169: If a 60-day note receivable is dated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents