Including REITs in a portfolio containing S&P 500 securities produces diversification benefits.Why?

A) Real estate investment returns are highly correlated with returns for stocks

B) Real estate investment returns are not highly correlated with returns for stocks

C) Real estate investment returns are not subject to federal income taxes

D) Real estate investment returns do not change much from year to year

Correct Answer:

Verified

Q1: When comparing investment alternatives,the standard deviation is

Q6: In comparison to portfolios comprised entirely of

Q6: The NCREIF index measures the investment performance

Q8: What statistical concept do many portfolio managers

Q9: An investor in a mortgage REIT is

Q13: On January 1st,an investor purchases security A

Q15: It is difficult to compare the investment

Q16: Consider an investment held over three years

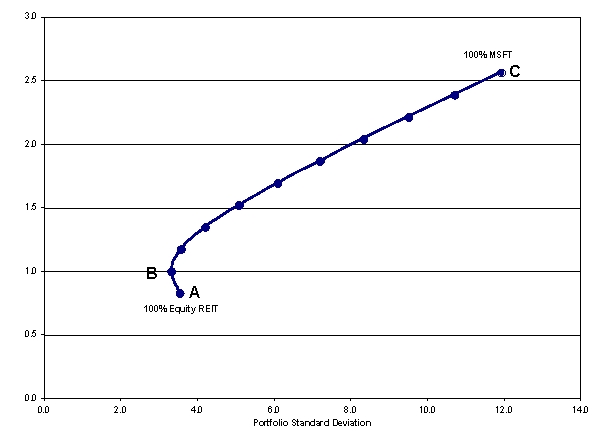

Q16: As long as the coefficient of correlation

Q20: The FRC Property Index includes property value

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents