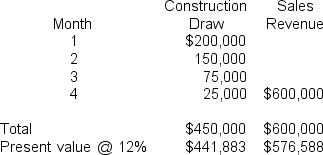

Refer to the information in the previous question.You have been advised that sales revenues may be 10 percent lower and/or development costs may be 10 percent higher.Performing a sensitivity analysis,you conclude:

A) A 10 percent decrease in sales revenues would have a bigger impact on returns than a 10 percent increase in development costs

B) A 10 percent increase in development costs would have a bigger impact on returns than a 10 percent decrease in sales revenues

C) A 10 percent increase in development costs and a 10 percent decrease in sales revenues would have opposite impacts on returns,canceling each other out and having no impact on returns

D) Both factors would have such a small impact,that there is no reason to be concerned about either a 10 percent increase in development costs or a 10 percent decrease in sales revenues

Correct Answer:

Verified

Q1: By using an option contract,a developer may

Q6: The land development industry is best characterized

Q8: Lenders typically insist on a loan repayment

Q11: Q13: In most instances,a developer's repayment rate is Q15: In order to obtain a land development Q20: A feasibility study analyzes whether a tract Q25: An analysis of whether land can be Q29: When financing land development,the lender generally requires Q33: Generally,which of the following is FALSE regarding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents