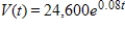

A 58-year-old couple are considering opening a business of their own. They will either purchase an established Gift and Card Shoppe or open a new Video Rental Palace. The Gift Shoppe has a continuous income stream with an annual rate of flow at time t given by  (dollars per year) and the Video Palace has a continuous income stream with a projected annual rate of flow at time t given by

(dollars per year) and the Video Palace has a continuous income stream with a projected annual rate of flow at time t given by  (dollars per year) . The initial investment is the same for both businesses, and money is worth 10% compounded continuously. Find the present value of the Video Palace over the next 8 years (until the couple reach age 66) . Round your answer to the nearest dollar.

(dollars per year) . The initial investment is the same for both businesses, and money is worth 10% compounded continuously. Find the present value of the Video Palace over the next 8 years (until the couple reach age 66) . Round your answer to the nearest dollar.

A) $222,961

B) $220,268

C) $202,618

D) $237,342

E) $181,863

Correct Answer:

Verified

Q71: Suppose that a printing firm considers the

Q72: A drug manufacturer has developed a time-release

Q73: The demand function for a certain product

Q74: A continuous income stream has an annual

Q75: The demand function for a product is

Q77: Suppose that the Carter Car Service franchise

Q78: Assume that the tax burden per capita

Q79: The Carter Car Service franchise has a

Q80: A franchise models the profit from its

Q81: Evaluate the integral ![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents