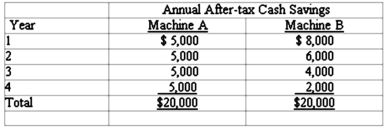

Levin Company is considering two new machines that should produce considerable cost savings in its assembly operations. The cost of each machine is $14,000 and neither is expected to have a salvage value at the end of a 4-year useful life. Levin's required rate of return is 12% and the company prefers that a project return its initial outlay within the first half of the project's life. The annual after-tax cash savings for each machine are provided in the following table:

Required:

1) Compute the payback period for each machine using the incremental approach and comment on the results.2) Compute the unadjusted rate of return based on average investment for each machine. The machines will be depreciated on a straight-line basis.3) Compute the net present value for each machine.4) Which machine would you recommend? Explain your reasoning.5) Use the present value table to compute the approximate internal rate of return for Machine.

Correct Answer:

Verified

1) Machine A: $14,000 ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q123: Indicate whether each of the following statements

Q124: Indicate whether each of the following statements

Q128: Describe the approach that managers may take

Q138: Select the term from the list provided

Q141: In Year 1, Chandler Company purchased

Q142: Omicron Company is considering purchasing equipment that

Q144: Gordon Company is considering a three-year

Q145: Bristles Hair Salon is considering installing spray

Q146: Pierce Company is considering the purchase of

Q146: Columbus Company is considering a project

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents