On January 1, 2017, Larmer Corp. (a Canadian company) purchased 80% of Martin Inc, an American company, for US$50,000.

Martin's book values approximated its fair values on that date except for plant and equipment, which had a fair value of US$30,000 with a remaining life expectancy of 5 years. A goodwill impairment loss of US$1,000 occurred during 2017. Martin's January 1, 2017 Balance Sheet is shown below (in U.S. dollars): The following exchange rates were in effect during 2017:

Dividends declared and paid December 31, 2017.

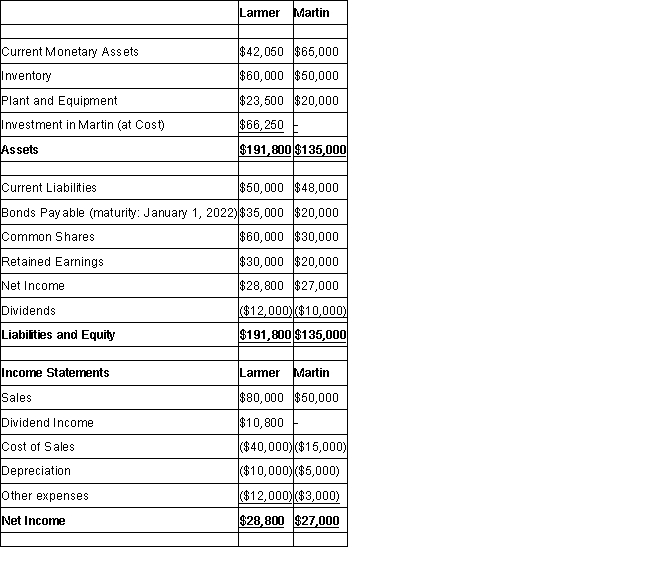

The financial statements of Larmer (in Canadian dollars) and Martin (in U.S. dollars) are shown below:

Balance Sheets

-Translate Martin's 2017 Income Statement into Canadian dollars if Martin is considered to be an integrated foreign subsidiary (i.e., the functional currency of the foreign operation is the same as the parent).

Correct Answer:

Verified

\...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: If Maker is considered to be a

Q45: If Maker is considered to be an

Q46: If Maker is considered to be a

Q47: Calculate the exchange gain or loss that

Q48: Translate Wilsen's 2017 Income Statement if Wilsen

Q50: Translate Wilsen's December 31, 2017 Balance Sheet

Q51: If Maker is considered to be a

Q52: Compute Wilsen's exchange gain or loss for

Q53: Translate Wilsen's December 31, 2017 Balance Sheet

Q54: Translate Wilsen's 2014 Income Statement if Wilsen

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents