Use the following information to answer questions 13-14.

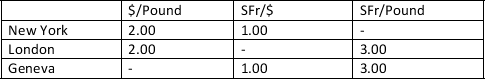

Assume that the following exchange rates exist.

-Suppose that you are an arbitrageur that starts with $100 in New York.Which of the following paths is correct in order to make arbitrage profit?

A) Buy pound in New York → sell pound for SFr in New York → sell SFr for dollar in New York.

B) Buy SFr in New York → sell SFr for pound in New York → sell pound for dollar in New York.

C) Buy SFr in New York → sell SFr for pound in Geneva → sell pound for dollar in New York.

D) Buy pound in New York → sell pound for SFr in London → sell SFr for dollar in New York.

Correct Answer:

Verified

Q61: Bid price is the price at which

Q62: If the Japanese yen was worth $.005

Q63: Use the graph below to answer questions

Q64: Use the graph below to answer questions

Q65: Use the following information to answer questions

Q66: Use the graph below to answer questions

Q67: The Citibank trading desk quotes a buy

Q68: Assume that the exchange rate is currently

Q69: If Citi in New York has a

Q70: The goal of an arbitrage transaction between

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents