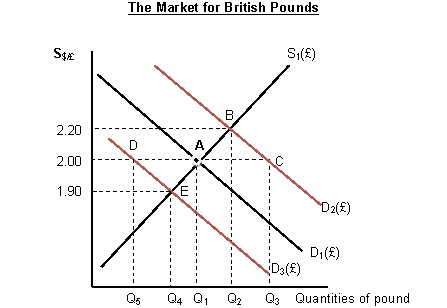

Use the graph below to answer questions 9-11.

Figure 2.3:

-Refer to Figure 2.3.Suppose that the U.K agreed to peg its currency against the U.S.dollar at $2.00 per pound during the Bretton Woods system.Assume that the U.S.decreases its imports from the U.K.As a result,the Bank of England would have to:

A) let the British pound appreciates

B) let the British pound depreciates

C) sell pounds and buy dollars in foreign exchange market.

D) sell dollars and buy pounds in foreign exchange market.

Correct Answer:

Verified

Q8: Q9: Which of the following could be considered Q10: _ occurs when a country abolishes its Q11: Suppose that under a gold standard,that the Q12: Consider the market for Chinese currency yuan.Suppose Q14: Which of the following economies has adopted![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents