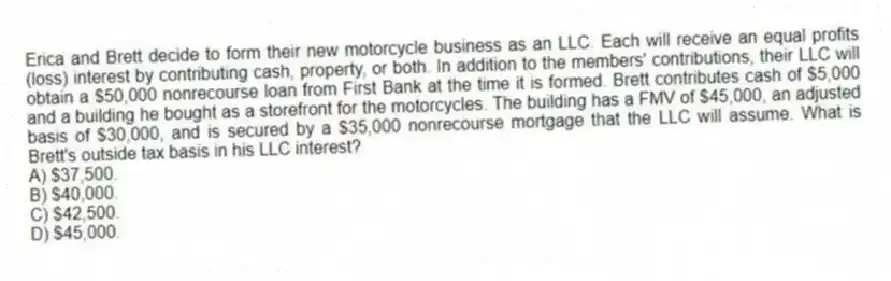

Erica and Brett decide to form their new motorcycle business as an LLC. Each will receive an equal profits (loss) interest by contributing cash, property, or both. In addition to the members' contributions, their LLC will obtain a $50,000 nonrecourse loan from First Bank at the time it is formed. Brett contributes cash of $5,000 and a building he bought as a storefront for the motorcycles. The building has a FMV of $45,000, an adjusted basis of $30,000, and is secured by a $35,000 nonrecourse mortgage that the LLC will assume. What is Brett's outside tax basis in his LLC interest?

A) $37,500.

B) $40,000.

C) $42,500.

D) $45,000.

Correct Answer:

Verified

Q24: Under general circumstances, debt is allocated from

Q24: Which of the following statements exemplifies the

Q26: Tom is talking to his friend Bob,

Q27: Which of the following entities is not

Q28: Which of the following statements regarding capital

Q30: In X1, Adam and Jason formed ABC,

Q31: Sarah, Sue, and AS Inc. formed a

Q33: The main difference between a partner's tax

Q35: A partner can generally apply passive activity

Q39: In what order should the tests to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents