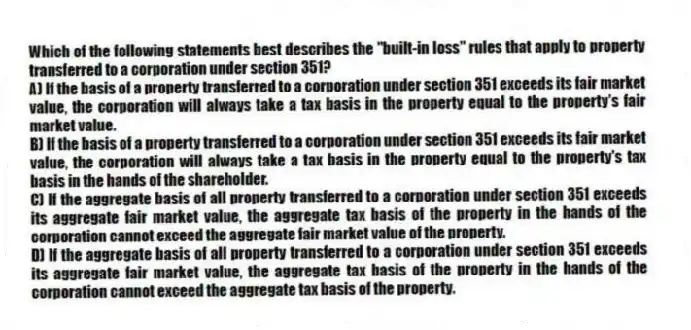

Which of the following statements best describes the "built-in loss" rules that apply to property transferred to a corporation under section 351?

A) If the basis of a property transferred to a corporation under section 351 exceeds its fair market value, the corporation will always take a tax basis in the property equal to the property's fair market value.

B) If the basis of a property transferred to a corporation under section 351 exceeds its fair market value, the corporation will always take a tax basis in the property equal to the property's tax basis in the hands of the shareholder.

C) If the aggregate basis of all property transferred to a corporation under section 351 exceeds its aggregate fair market value, the aggregate tax basis of the property in the hands of the corporation cannot exceed the aggregate fair market value of the property.

D) If the aggregate basis of all property transferred to a corporation under section 351 exceeds its aggregate fair market value, the aggregate tax basis of the property in the hands of the corporation cannot exceed the aggregate tax basis of the property.

Correct Answer:

Verified

Q43: Rachelle transfers property with a tax basis

Q44: Which of the following statements best describes

Q46: Rachelle transfers property with a tax basis

Q49: Sami transferred property with a fair market

Q51: Amy transfers property with a tax basis

Q56: Which of the following statements does not

Q64: Which of the following statements best describes

Q72: Jasmine transferred 100 percent of her stock

Q73: Simone transferred 100 percent of her stock

Q74: Which of the following statements best describes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents