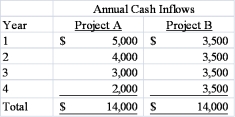

Chichester Company is considering investing in the following two mutually exclusive projects:

Required:

1) Which project is more desirable strictly in terms of cash inflows? Why?

2) Compute the present value of each project's cash inflows assuming the company's required rate of return is 10%.

3) What is the maximum amount Chichester should be willing to pay for each project?

4) Suppose each project costs $10,000. Which project(s) should be accepted?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q126: Indicate whether each of the following statements

Q127: Indicate whether each of the following statements

Q130: Describe the general approaches companies may use

Q132: Indicate whether each of the following statements

Q133: What is a postaudit of a capital

Q133: Redmond Company is considering investing in

Q134: Indicate whether each of the following statements

Q135: Indicate whether each of the following statements

Q136: Indicate whether each of the following statements

Q138: How would an organization benefit from conducting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents