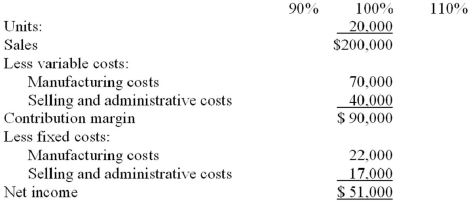

The Jordan Company, estimating its sales to be 20,000 units for the upcoming period, prepared the following static budget:

The owner of the business is not so sure about the 20,000 unit sales volume and has requested additional budgets.

Required:

In the table provided, prepare two additional budgets, one at 90% of the static budget volume level and one at 110% of the static budget volume level.

Flexible budgets at 90% and 110%:

Correct Answer:

Verified

Q126: If Paterno Company's turnover measure is 2.5

Q127: Bane Accounting Services planned to charge its

Q128: Suboptimization refers to actions taken by a

Q129: Matching. Select the term from the list

Q130: Matching. Select the term that best fits

Q132: An investment opportunity with a residual income

Q133: Most large organizations establish responsibility centers (sections,

Q134: Engle Manufacturing Company established the following

Q135: Unfavorable variances are bad; favorable variances are

Q136: Chance Company estimates sales of 13,000 units

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents