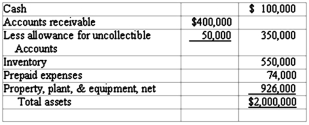

Longwood Company had a current ratio of 3:1 at the end of 2013. The asset section of the company's balance sheet is provided below:

Required:

1) Compute Longwood Company's end-of-year working capital.

2) Compute the company's quick (acid-test) ratio.

3) The company has a debt agreement with its bank that authorizes the bank to call in its loan to the company if the company's current ratio falls below 3:1 as of the last day of any month during the term of the loan. During January 2014, the company engaged in the three following transactions:

(a) Collected $100,000 on account;

(b) Purchased inventory on account, $50,000

(c) Paid accounts payable, $60,000

Will the company be in default after completing these transactions? Justify your answer.

Round your answers to two decimal places.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q141: For 2014, Weston Corporation reported after-tax net

Q142: The following information is from the

Q143: A careless accountant splattered spaghetti sauce on

Q144: Montana Company reported the following operating

Q145: Comparative income statements for Chicago Company are

Q146: Comparative income statements for Pearle Company are

Q148: Maynard Company's balance sheet and income statement

Q149: On December 31, 2013, Houston Company's total

Q150: Selected financial information for Martin Company

Q151: On December 31, 2013, Allen Company's total

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents