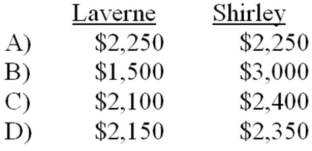

Laverne and Shirley started a partnership. Laverne invested $4,000 in the business and Shirley invested $6,000. The partnership agreement stipulated that profits would be divided as follows. Each partner would receive a 10% return on their invested capital with the remaining income being distributed equally between the two partners. Assuming that the partnership earned $4,500 during an accounting period, the amount of income assigned to the two partners would be:

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Correct Answer:

Verified

Q6: Tyrone Gonzales started a sole proprietorship by

Q7: Which of the following entities would have

Q8: The difference between the corporate form of

Q9: The term "Retained Earnings" is best explained

Q10: The term "double taxation" refers to which

Q12: The par value of common stock

A) changes

Q13: On February 2, 2014, Barker's Pool Supply

Q14: Which of the following terms designates the

Q15: On January 2, 2014, the Hoover Corporation

Q16: Flynn Corp., which is authorized to issue

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents