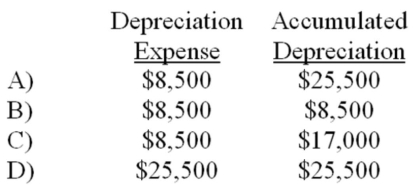

On January 1, 2014, Racine Company purchased equipment that cost $55,000 cash. The equipment had an expected useful life of six years and an estimated salvage value of $4,000. Assuming that Racine depreciates its assets under the straight-line method, the amount of depreciation expense appearing on the December 31, 2015 income statement and the amount of accumulated depreciation appearing on the December 31, 2015 balance sheet would be:

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Correct Answer:

Verified

Q4: Which one of the following would not

Q5: Benton Corporation acquired real estate that contained

Q6: Which of the following would be classified

Q7: Which method of depreciation is used by

Q8: Which of the following is not classified

Q10: On January 1, 2014, Rowley Company purchased

Q11: Which of the following is an intangible

Q12: Zabinski Co. paid $150,000 for a purchase

Q13: On January 1, 2014, Rugh Company purchased

Q14: Which of the following is considered an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents