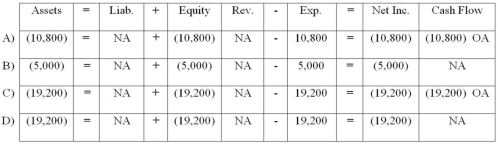

Remsen, Inc. purchased equipment that cost $48,000. The equipment had a useful life of 5 years and a $5,000 salvage value. Remsen used the double-declining-balance method to depreciate its assets. Which of the following choices accurately reflects how the recognition of the first year's depreciation would affect the company's financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Correct Answer:

Verified

Q28: Rouse Company owned an asset that had

Q29: Laurens Company purchased equipment that cost $10,000

Q30: On September 10, 2014, Barden Company sold

Q31: On January 1, 2014, Gray Company purchased

Q32: On January 1, 2010, Desmet Company purchased

Q34: An asset with a book value of

Q35: On January 1, 2014, Santa Fe Company

Q36: Sweetwater Company paid cash to prolong the

Q37: Philips Corporation purchased a truck that cost

Q38: Which of the following statements is true

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents