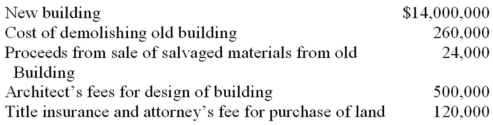

On May 4, 2014, Regan Company purchased a tract of land as a factory site for $3,000,000. An existing building on the property was demolished, and construction was begun on a new factory building in July 2014 and completed December 15, 2014. Cost data are shown below.

Required:

Compute the amounts that should be recorded as the cost of a) the land and b) the new factory building.

Correct Answer:

Verified

Q25: Explain how a choice of depreciation methods

Q26: Explain the meaning of "impairment" as used

Q126: Define "accelerated depreciation method" and give an

Q127: Smith Corporation purchased land and a building

Q128: How is the book value of an

Q130: On which financial statement(s) would the account

Q133: Explain how a business using the straight-line

Q134: How does the treatment of goodwill differ

Q135: Give two examples of natural resources.

Q136: On January 2, 2012, Brimm Corporation purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents