Teague Company purchased a new machine on January 1, 2014, at a cost of $150,000. The machine is expected to have an eight-year life and a $15,000 salvage value. The machine is expected to produce 675,000 finished products during its eight-year life. Smith produced 70,000 units in 2014 and 110,000 units during 2015.

Required:

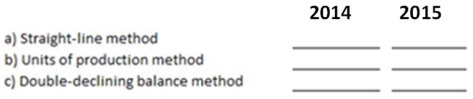

Determine the amount of depreciation expense to be recorded on the machine for the years 2014 and 2015 under each of the following methods:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Explain how the gain or loss is

Q24: For what types of assets is the

Q26: Explain the meaning of "impairment" as used

Q133: Explain how a business using the straight-line

Q134: How does the treatment of goodwill differ

Q135: Give two examples of natural resources.

Q136: On January 2, 2012, Brimm Corporation purchased

Q138: Describe what is meant by the term

Q141: In January 2014, Rogers Co. purchased a

Q142: Clampett Corporation paid cash to acquire land

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents