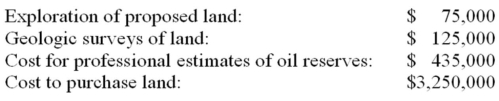

Clampett Corporation paid cash to acquire land to be used for oil production. The costs incurred by Clampett were the following:

Estimates were made that 12,500,000 gallons of crude oil can be extracted from the site over the life of the asset.

Required:

Given that Clampett was able to extract

a) 230,000 gallons in the first year,

b) 975,000 gallons in the second year, and

c) 854,000 gallons in the third year,

calculate the depletion charge for each year

Correct Answer:

Verified

$3,885,000 ÷ ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Explain how the gain or loss is

Q24: For what types of assets is the

Q137: Teague Company purchased a new machine on

Q138: Describe what is meant by the term

Q141: In January 2014, Rogers Co. purchased a

Q143: On January 1, 2014, St. John Corp.

Q144: In 2014, Albert Mining Co. purchased a

Q145: On January 1, 2014, Stassi Corporation purchased

Q146: On January 1, 2014, Studer Corporation paid

Q147: Muller Corporation purchased a new truck on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents