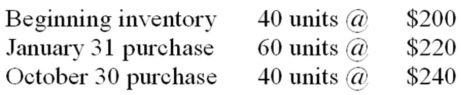

During November 2014, Cooper Company sold 120 units of a product for $375 each. Selling and administrative expenses for the year were $14,000. All transactions were cash transactions. The following information is also available about Cooper's inventory and purchases:

The company's income tax rate is 30%.

Required:

a) Prepare an income statement for Cooper Company for 2014 assuming:

1) FIFO inventory cost flow

2) LIFO inventory cost flow

b) Prepare the operating activities section of the Statement of Cash Flows for 2014 assuming:

1) FIFO inventory cost flow

2) LIFO inventory cost flow

Correct Answer:

Verified

1) FIFO cost of g...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q140: If Schulze Company is using FIFO, how

Q141: Stewart Company sold 180 units @

Q142: Maple Company started the year with

Q143: Fairleigh Company sells home weather stations.

Q144: The following information is for Carmen Company

Q145: Hines Enterprises loaned $4,000 to Baldwin Company

Q146: Mohr Manufacturing, Inc. had the following

Q147: The Repair Shop provided $618,000 of services

Q148: Riley Corporation accepted credit cards for $107,200

Q150: Zephyr Sewing Machine Company makes many of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents