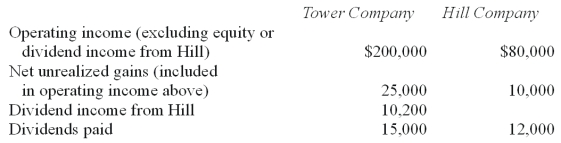

Tower Company owns 85% of Hill Company. The two companies engaged in several intra-entity transactions. Each company's operating and dividend income for the current time period follow, as well as the effects of unrealized gains. No income tax accruals have been recognized within these totals. The tax rate for each company is 30%.

-Using percentage allocation method, how much income tax expense is assigned to Hill?

A) $21,000.

B) $24,000.

C) $20,400.

D) $17,400.

E) $0.

Correct Answer:

Verified

Q41: Which of the following is true concerning

Q47: Which of the following conditions will allow

Q51: Woods Company has one depreciable asset valued

Q55: Why might a consolidated group file separate

Q58: How is goodwill amortized?

A) It is not

Q59: White Company owns 60% of Cody Company.

Q61: Alpha Corporation owns 100 percent of Beta

Q63: Alpha Corporation owns 100 percent of Beta

Q64: Delta Corporation owns 90 percent of Sigma

Q65: Alpha Corporation owns 100 percent of Beta

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents