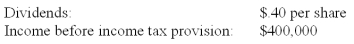

On January 1, 2011, Youder Inc. bought 120,000 shares of Nopple Co. for $384,000, giving Youder 30% ownership and the ability to apply significant influence to the operating and financing decisions of Nopple. Youder anticipated holding this investment for an indefinite time. In making this acquisition, Youder paid an amount equal to the book value for these shares. The fair value of each asset and liability was the same as its book value. Dividends and income for Nopple for 2011 were as follows:

Required:

Assume a 40% income tax rate. Prepare all necessary journal entries for Youder for 2011 beginning at acquisition and ending at tax accrual.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q97: Wilkins Inc. owned 60% of Motumbo Co.

Q102: For each of the following situations, select

Q104: How much will the consolidated group save

Q106: On January 1, 2010, Mace Co. acquired

Q107: Dice Inc. owns 40% of the outstanding

Q107: Patton's operating income excludes income from the

Q108: Jull Corp. owned 80% of Solaver Co.

Q109: Kurton Inc. owned 90% of Luvyn Corp.'s

Q110: On January 1, 2010, Mace Co. acquired

Q115: What ownership structure is referred to as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents