On January 1, 2011, John Doe Enterprises (JDE) acquired a 55% interest in Bubba Manufacturing, Inc. (BMI). JDE paid for the transaction with $3 million cash and 500,000 shares of JDE common stock (par value $1.00 per share). At the time of the acquisition, BMI's book value was $16,970,000.

On January 1, JDE stock had a market value of $14.90 per share and there was no control premium in this transaction. Any consideration transferred over book value is assigned to goodwill. BMI had the following balances on January 1, 2011. For internal reporting purposes, JDE employed the equity method to account for this investment.

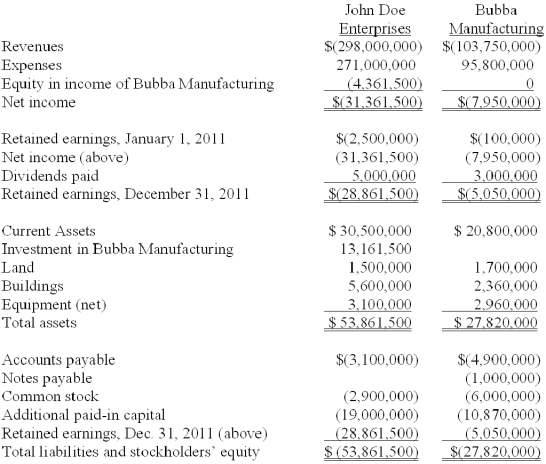

-The following account balances are for the year ending December 31, 2011 for both companies.

Required:

Prepare a consolidation worksheet for this business combination. Assume goodwill has been reviewed and there is no goodwill impairment.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: On January 1, 2008, prior to the

Q102: How is a noncontrolling interest in the

Q107: Using the acquisition method, determine the amount

Q107: On January 1, 2010, Jannison Inc.

Q108: On January 1, 2008, prior to the

Q109: On January 1, 2010, Jannison Inc. acquired

Q110: Determine the value assigned to the noncontrolling

Q110: On January 1, 2011, John Doe

Q111: Pennant Corp. owns 70% of the common

Q117: Determine the amount of the noncontrolling interest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents