Figure:

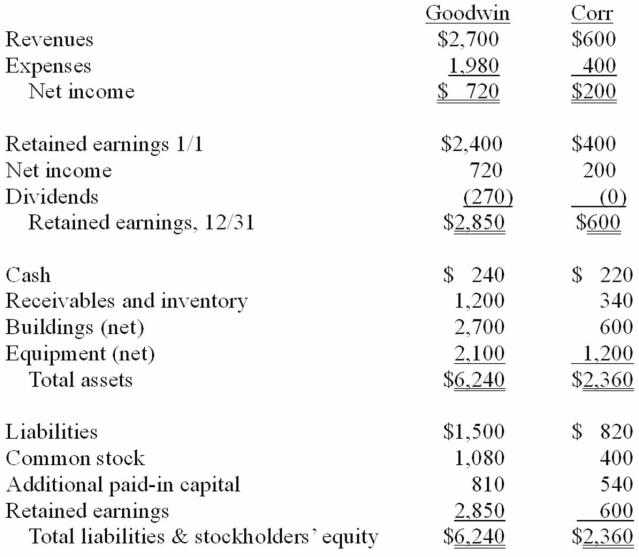

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated retained earnings at December 31, 20X1.

A) $2,800.

B) $2,825.

C) $2,850.

D) $3,425.

E) $3,450.

Correct Answer:

Verified

Q43: Compute the amount of consolidated cash after

Q44: Compute the amount of consolidated inventories at

Q48: Compute the amount of consolidated additional paid-in

Q49: Compute the amount of consolidated buildings (net)

Q49: Figure:

The financial balances for the Atwood Company

Q52: Figure:

On January 1, 20X1, the Moody

Q56: Compute the amount of consolidated common stock

Q58: At the date of acquisition, by how

Q58: Figure:

The financial balances for the Atwood Company

Q63: Compute consolidated buildings (net) at the date

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents