Figure:

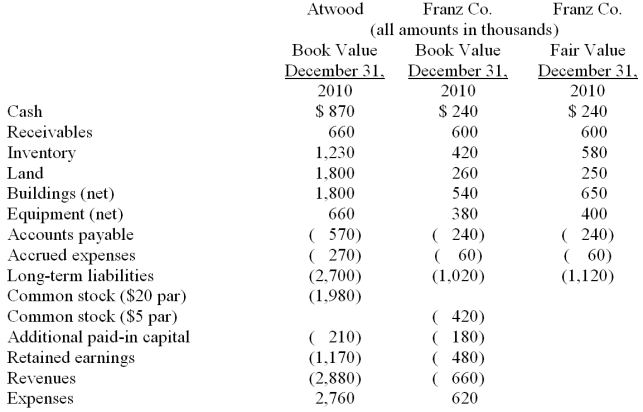

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

-Compute consolidated revenues at date of acquisition.

A) $3,540.

B) $2,880.

C) $1,170.

D) $1,650.

E) $4,050.

Correct Answer:

Verified

Q60: Figure:

Carnes has the following account balances

Q63: Figure:

The financial balances for the Atwood Company

Q64: Figure:

The financial balances for the Atwood Company

Q66: Figure:

Flynn acquires 100 percent of the outstanding

Q67: Figure:

Flynn acquires 100 percent of the outstanding

Q68: Figure:

Presented below are the financial balances for

Q70: Figure:

Presented below are the financial balances for

Q74: Compute the consolidated cash upon completion of

Q75: Compute fair value of the net assets

Q79: Compute consolidated retained earnings at the date

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents