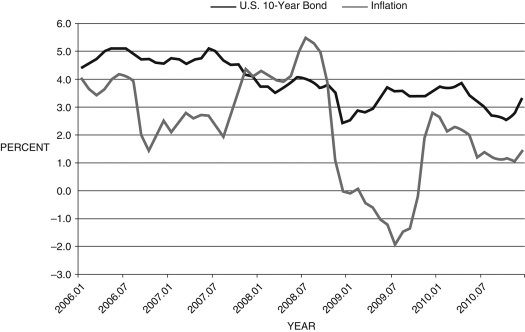

The following figure shows the inflation rate and ten-year bond yield. Refer to this figure when answering

Figure 14.4: Inflation and 10-Year Bond Yields

-Consider Figure 14.4 above. Throughout the first three-fourths or so of 2009 the:

A) real interest rate on 10-year bonds was lower than the nominal interest rate

B) 10-year-bonds' nominal interest rate was higher than the real interest rate

C) inflation rate was negative

D) real interest rate was negative

E) inflation rate was higher than the nominal interest rate

Correct Answer:

Verified

Q4: The financial friction:

A) is equal to zero

Q21: The Fisher equation is given by:

A)

Q22: When the Fed lowers the nominal

Q23: The effect of the subprime loan crisis

Q24: When inflation is negative it:

A) raises the

Q25: If the rate of inflation is -2

Q28: If the rate of inflation is 2

Q32: In the IS/MP framework, when the Fed

Q36: In the IS/MP framework, when the Fed

Q57: Deflation usually arises due to _. This

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents