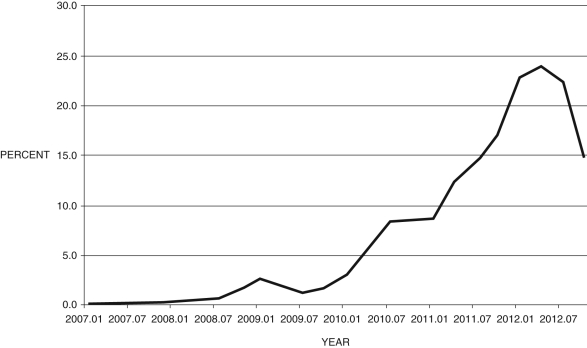

Figure 15.6 shows the difference between Greek and German 10-year bond yields from 2007-2013. Answer the following questions:

a. What does this data represent?

b. In the Smets-Wouters DSGE model, what type of shock is this?

c. How does this shock affect the macroeconomy in the Smets-Wouters DSGE model? Explain.

Figure 15.6: 10-Year Bond Yields: Greece minus Germany

(Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q100: The first order condition from the

Q101: In the stylized DSGE model with

Q103: In the Smets-Wouters DSGE model presented in

Q104: You are a finance minister in Iceland

Q104: In the Smets-Wouters DSGE model, consumption falls

Q107: Sticky nominal wages can lead to a

Q108: In December 2010, Congress and President Obama

Q112: With a nominal price rigidity, firms cannot

Q115: Inflation falls following the introduction of a

Q116: In 2013, there were numerous global conflicts:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents