Refer to the following figure when answering the next two questions.

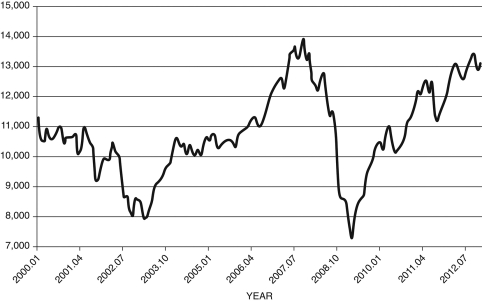

Figure 17.2: Dow Jones Industrial Average: 2000-2012

(Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

-Your uncle asks you to explain stock prices based on the financial capital arbitrage equation. He shows you the graph shown in Figure 17.2. He asks you to explain the cause in the rise of stock prices for the years 2002-2006. What do you tell him?

A) "As the DJI rises, there are financial capital gains that drive up stock prices."

B) "The rise in the DJI implies there was an incentive for Congress to increase corporate tax rates, which would have led to falling capital investment. With less capital, stock prices rise."

C) "The rising DJI leads to falling dividend payments, which would lead to a decline in physical capital accumulation. With less capital available, the marginal product of capital rises, leading to higher stock prices."

D) "A rising DJI decreases the MPK."

E) "Rising capital gains, as shown in the figure, have no impact on stock prices."

Correct Answer:

Verified

Q43: If the bank real interest rate is

Q47: Refer to the following figure when answering

Q49: Since 1980, interest rates have been trending

Q50: If the savings interest rate rises, to

Q56: According to the financial asset arbitrage equation,

Q57: If the marginal product of capital is

Q63: The arbitrage condition for residential investment

Q72: A financial market is efficient if financial

Q79: You decide to move to the mountains

Q81: In a booming economy, _ and so

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents