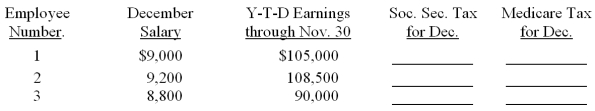

The monthly salaries for December and the year-to-date earnings as of November 30 for the three employees of Heather's Hair Salon are listed below. Compute the amount of social security tax and Medicare tax to be withheld from each of the employee's gross pay for December. Assume a 6.2 percent social security tax rate and a base of $106,800 for the calendar year. Assume a 1.45 percent Medicare tax rate.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: The Royal Company has office employees and

Q64: FICA taxes are paid by:

A) employees only.

B)

Q65: The monthly salaries for December and the

Q66: During the week ended January 11, 2013,

Q67: During one week, three employees of

Q69: The Rollins Company has office employees and

Q70: The monthly salaries for December and the

Q71: The monthly salaries for December and the

Q74: The total amount earned by the employee

Q76: Rick O'Shea,the only employee of Hunter Furniture

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents