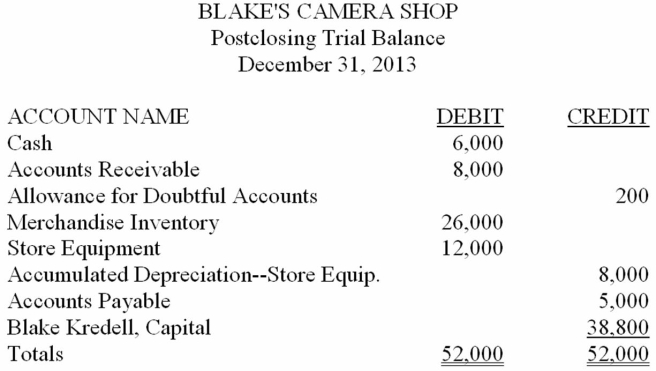

Blake Kredell owns and operates a retail business called Blake's Camera Shop. His postclosing trial balance on December 31, 2013, is provided below. Blake plans to enter into a partnership with Carmen Santos, effective January 1, 2014. Profits and losses will be shared equally. Blake will transfer all assets and liabilities of his store to the partnership, after revaluation. Santos will invest cash equal to Blake's investment after revaluation. The agreed values are: Accounts Receivable (net), $7,500; Merchandise Inventory, $27,000; and Store Equipment, $8,000.The partnership will operate under the name Picture Perfect. Record each partner's investment on page 1 of a general journal. Omit descriptions.

Prepare a balance sheet for Picture Perfect just after the investments.

Correct Answer:

Verified

Q44: Mary Ann Mason operates a sole proprietorship

Q45: Janice Miller operates a sole proprietorship business

Q49: Partnership net income of $132,000 is to

Q52: The salary and interest allowances in a

Q62: Kara Johnson and Tyler Jones are partners,

Q64: Partnership net income of $33,000 is to

Q66: Sam McGuire and Marcos Valle are partners,and

Q70: The entry to record a partner's salary

Q71: The entry to record the equal distribution

Q83: If an individual invests more cash for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents