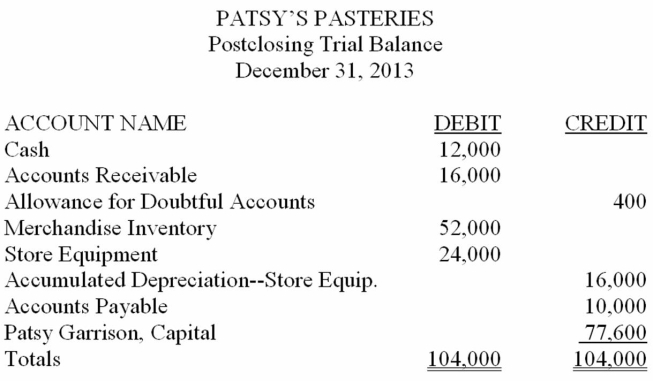

Patsy Garrison owns and operates a bakery called Patsy's Pasteries. Her postclosing trial balance on December 31, 2013, is provided below. Garrison plans to enter into a partnership with Erika Noreen, effective January 1, 2014. Profits and losses will be shared equally. Garrison will transfer all assets and liabilities of her store to the partnership, after revaluation. Noreen will invest cash equal to Garrison's investment after revaluation. The agreed values are: Accounts Receivable (net), $15,000; Merchandise Inventory, $54,000; and Store Equipment, $16,000. The partnership will operate under the name Baker's Delight. Record each partner's investment on page 1 of a general journal. Omit descriptions.

Prepare a balance sheet for Baker's Delight just after the investments.

Correct Answer:

Verified

Q61: Net income for the Gifts Galore for

Q62: Nancy Conradt and Chris Russell are partners

Q63: Madison and Hamilton are partners who share

Q65: Martinez and Lopez are partners in business

Q66: Bryce and Kendall are partners. The partnership

Q67: Catherine Vollick and Danica Hubbard are partners.

Q68: Escobar and Woods are partners who share

Q69: Which of the following statements is correct?

A)If

Q69: Walters and Kim are partners. The partnership

Q79: If no other method of dividing net

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents