End-of-period adjustments-effect on profit

Ocean View Limited reported revenues of $645,000 and expenses of $360,000 for the month of May, before making any month-end adjusting entries. The following data are provided regarding adjusting entries:

(A.) Portion of insurance expiring in May, $2,520.

(B.) A customer has used the facilities for two weeks in May; the fee of $4,200 has not yet been billed.

(C.) Amount owed for salaries accrued in the last week of May, $1,650.

(D.) Depreciation on equipment for May $1,290.

(E.) Supplies used in May, $13,125.

(F.) Fees collected in advance which have been earned during May, $23,400.

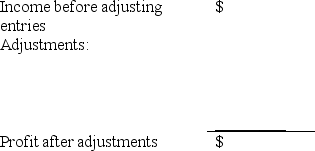

Complete the schedule to determine the profit of Ocean View Limited. for May after these adjustments have been recorded. Begin your schedule with income before adjusting entries and then show the effect of each adjustment to arrive at profit after adjustment.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q78: The equipment had an estimated useful life

Q86: Under accrual accounting,salaries earned by employees but

Q111: Adjusting entries-effect on elements of financial

Q114: Tuna Co. purchased a building in 2009

Q114: Swordfish Co. earned $75,000 in 2009 and

Q117: Adjusting entries-effect on elements of financial

Q117: Adjusting Entries

Identify four types of timing differences

Q118: Dolphin Co. received $1,500 in fees during

Q118: End-of-period adjustments-effect on profit

Before making any year-end

Q119: Accounting terminology

Listed below are nine technical

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents