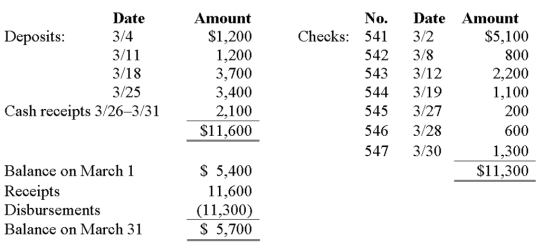

Madison Company's cash ledger reports the following for the month ending March 31, 2012.  Information from March's bank statement and company records reveals the following additional information:

Information from March's bank statement and company records reveals the following additional information:

a. The ending cash balance recorded in the bank statement is $6,790.

b. Cash receipts of $2,100 from 3/26-3/31 are outstanding.

c. Checks 545 and 547 are outstanding.

d. The deposit on 3/11 included a customer's check for $400 that did not clear the bank (NSF

check).

e. Check 543 was written for $2,800 for office supplies in March. The bank properly recorded the check for this amount.

f. An automatic withdrawal for March rent was made on March 4 for $1,500.

g. Madison's checking account earns interest based on the average daily balance. The amount of interest earned for March is $50.

h. Last year, one of Madison's top executives borrowed $4,000 from Madison. On March 24, the executive paid $4,200 ($4,000 borrowed amount plus $200 interest) directly to the bank in payment for the borrowing.

i. The bank charged the following service fees: $30 for NSF check, $10 for automatic withdrawal for rent payment, and $20 for collection of the loan amount from the executive.

Prepare a bank reconciliation for March 31, 2012, and record the necessary cash adjustments.

Correct Answer:

Verified

Q121: A company establishes a petty cash fund

Q138: A company had the following sales transactions:

1.

Q143: Listed below are five terms followed by

Q144: A company establishes a $400 petty

Q146: Indicate whether the firm should add or

Q147: Regarding a bank reconciliation, which one of

Q148: The following information pertains to Sooner

Q154: Describe the procedures used to reconcile a

Q163: Listed below are six terms followed by

Q170: Listed below are five terms followed by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents