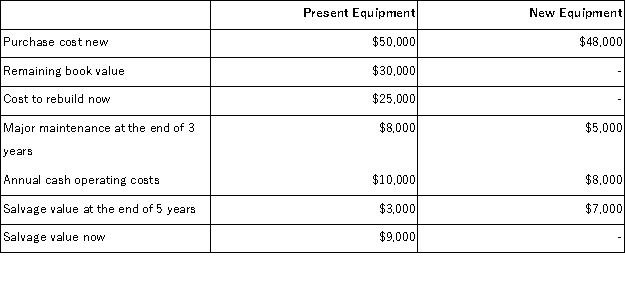

Carlson Manufacturing has some equipment that needs to be rebuilt or replaced. The following information has been gathered relative to this decision:  Carlson uses the total cost approach to net present value analysis and a discount rate of 12%. Regardless of which option is chosen, rebuild or replace, at the end of five years Carlson Manufacturing will have no future use for the equipment. If the new equipment is purchased, the present value of the annual cash operating costs associated with this alternative is:

Carlson uses the total cost approach to net present value analysis and a discount rate of 12%. Regardless of which option is chosen, rebuild or replace, at the end of five years Carlson Manufacturing will have no future use for the equipment. If the new equipment is purchased, the present value of the annual cash operating costs associated with this alternative is:

A) ($28,840)

B) ($19,160)

C) ($14,420)

D) ($36,050)

Correct Answer:

Verified

Q60: Valotta Corporation has provided the following data

Q61: The Halsey Corporation is contemplating the purchase

Q62: An expansion at Fidell, Inc., would increase

Q63: The management of Duker Corporation is investigating

Q64: Carlson Manufacturing has some equipment that needs

Q66: Mercer Corporation is considering replacing a technologically

Q67: Jimba's, Inc., has purchased a new donut

Q68: The management of Stanforth Corporation is investigating

Q69: Carlson Manufacturing has some equipment that needs

Q70: Baldock Inc. is considering the acquisition of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents