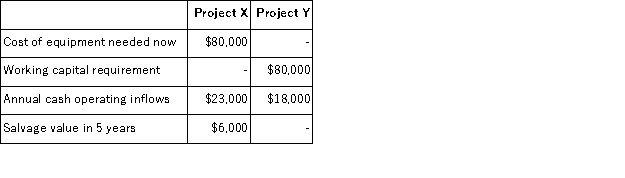

The Sawyer Corporation has $80,000 to invest and is considering two different projects, X and Y. The following data are available on the projects:  Both projects will have a useful life of 5 years; at the end of 5 years, the working capital will be released for use elsewhere. Sawyer's discount rate is 12%. The net present value of project X is closest to:

Both projects will have a useful life of 5 years; at the end of 5 years, the working capital will be released for use elsewhere. Sawyer's discount rate is 12%. The net present value of project X is closest to:

A) $2,915

B) ($11,708)

C) $5,283

D) $6,317

Correct Answer:

Verified

Q90: Alesi Corporation is considering purchasing a machine

Q91: Westland College has a telephone system that

Q92: Flamio Corporation is considering a project that

Q93: Swaggerty Corporation is considering purchasing a machine

Q94: Consider the following three investment opportunities:

Project I

Q96: The management of Mashiah Corporation is considering

Q97: Betterway Pharmacy has purchased a small auto

Q98: Clairmont Corporation is considering the purchase of

Q99: Westland College has a telephone system that

Q100: The Sawyer Corporation has $80,000 to invest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents